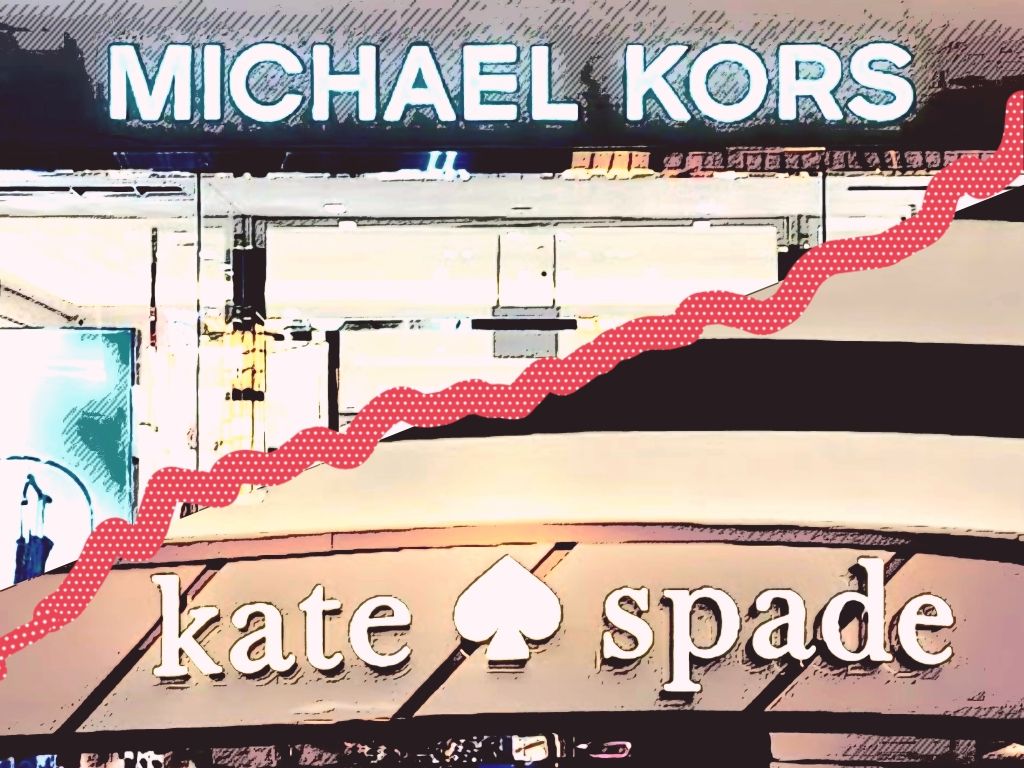

A US judge obstructed two large groups from forming a larger new entity in a case that has been dubbed “the legal battle shaking the US fashion industry”. The parent of Michael Kors and the owner of Kate Spade shall not merge

The merger is halted. America’s Federal Trade Commission (FTC) won. The company that owns Kate Spade and Coach, Tapestry, and the parent of Michael Kors and Versace, Capri, were not given the okay to merge. If they were successful, the new group would have formed what industry watchers in the US said will allow it to have “dominant share” of the valuable market for “accessible” luxury handbags, estimated to be 58 percent. “Antitrust has come into fashion,” the judge wrote in her conclusion. In April, the FTC sued to block the merger; it argued that if the merger is approved, the new company will dominate the market. There is no certainty, therefore, that they would not raise prices. The court’s freezing of the merger is considered a resounding triumph for shoppers. The FTC released a statement, saying that the “decision is a victory not only for the FTC, but also for consumers across the country seeking access to quality handbags at affordable prices.”

When Michael Kors was in court last month to testify against the case the FTC brought against the merger, he said that his eponymously-branded handbags have been harder to move in a fashion world dependent on what trends on social media, such as TikTok. He described the response to his products as one that was somewhat tepid now. “Sometimes you’ll be the hottest thing on the block,” he said. “Sometimes you’ll be lukewarm. Sometimes you’ll be cold.” The temperature doubtlessly has been hovering over the low end. He said, “I think we’ve reached the point of brand fatigue.” In the past years, headlines that announced the brand’s steep markdowns abounded: “Michael Kors designer bag, normally US$289, on sale for US$58”, read one. It is not clear how keeping the prices of their “designer bags” affordable will better their business. Or, if the merger were successful, the low price would augment the brand positioning, already not on positive, atas territory.